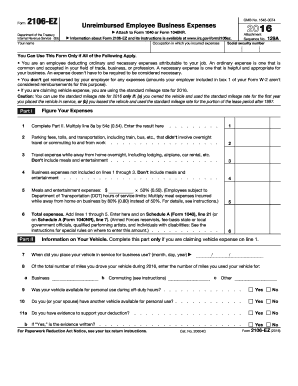

IRS 2106-EZ 2017-2026 free printable template

Instructions and Help about IRS 2106-EZ

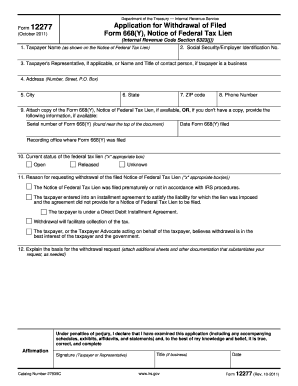

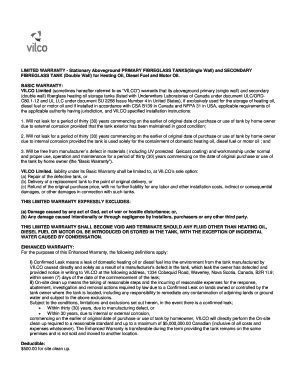

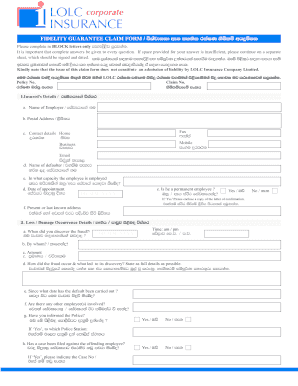

How to edit IRS 2106-EZ

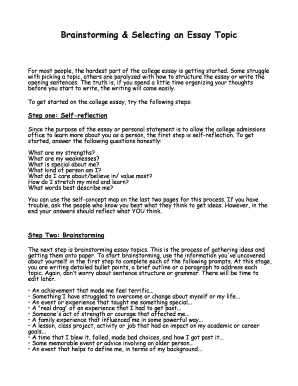

How to fill out IRS 2106-EZ

Latest updates to IRS 2106-EZ

All You Need to Know About IRS 2106-EZ

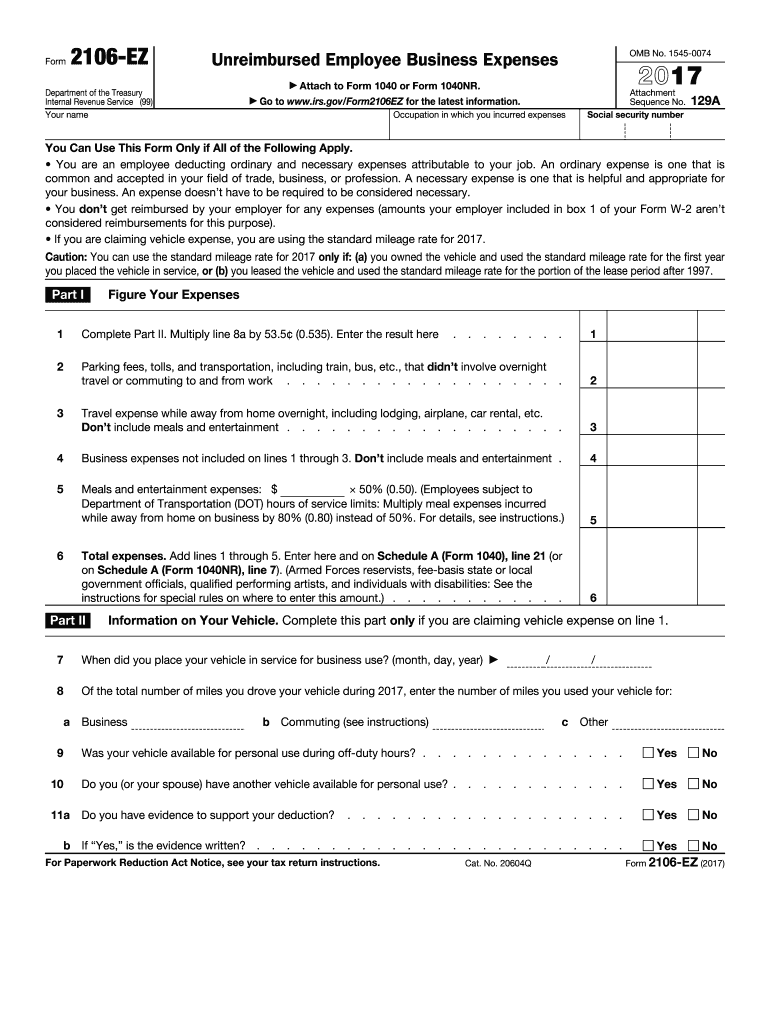

What is IRS 2106-EZ?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 2106-EZ

What should I do if I realize I've made a mistake on my IRS 2106-EZ after submission?

If you discover an error on your IRS 2106-EZ after it has been submitted, you will need to file an amended return. Use Form 1040-X for this process, and clearly indicate the changes made. Keep documentation of your original submission and any evidence supporting your amendments.

How can I verify the status of my IRS 2106-EZ submission?

To track the status of your IRS 2106-EZ submission, you can use the IRS 'Where's My Refund?' tool if you expect a refund. If you filed electronically, check your e-file software for status updates or rejection notifications. Be aware of common e-file rejection codes that could signal issues needing resolution.

What should I do if I receive a notice or letter from the IRS regarding my IRS 2106-EZ?

Upon receiving a notice from the IRS concerning your IRS 2106-EZ, carefully read the communication to understand the issue. Gather any necessary documentation and respond promptly within the timeframe specified to avoid penalties. If you're uncertain, consider consulting a tax professional for guidance.

Are there specific service fees associated with electronically filing the IRS 2106-EZ?

Yes, many e-filing services charge a fee for filing the IRS 2106-EZ electronically. The fees can vary based on the provider and the complexity of your return. Be sure to compare options, and check if refunds are available in case your submission is rejected.

Can I file the IRS 2106-EZ on behalf of someone else, such as a family member or friend?

Filing the IRS 2106-EZ on behalf of another individual requires you to have proper authorization, such as a Power of Attorney (POA). Ensure that all required signatures are obtained and that you follow the necessary steps set by the IRS for submitting forms on behalf of someone else.